Why Real Estate is a Good Inflation Hedge for Investors

Since the pandemic began nearly two years ago investors saw asset classes balloon in value. From stocks to cryptocurrencies to home prices, financial markets and more traditional asset classes witnessed extraordinary growth, driven by unprecedented fiscal stimulus, robust consumer spending, and a strong labor market.

But now, as the world begins to remerge from Covid-19 the record-breaking amount of fiscal stimulus is showing to have adverse effects.

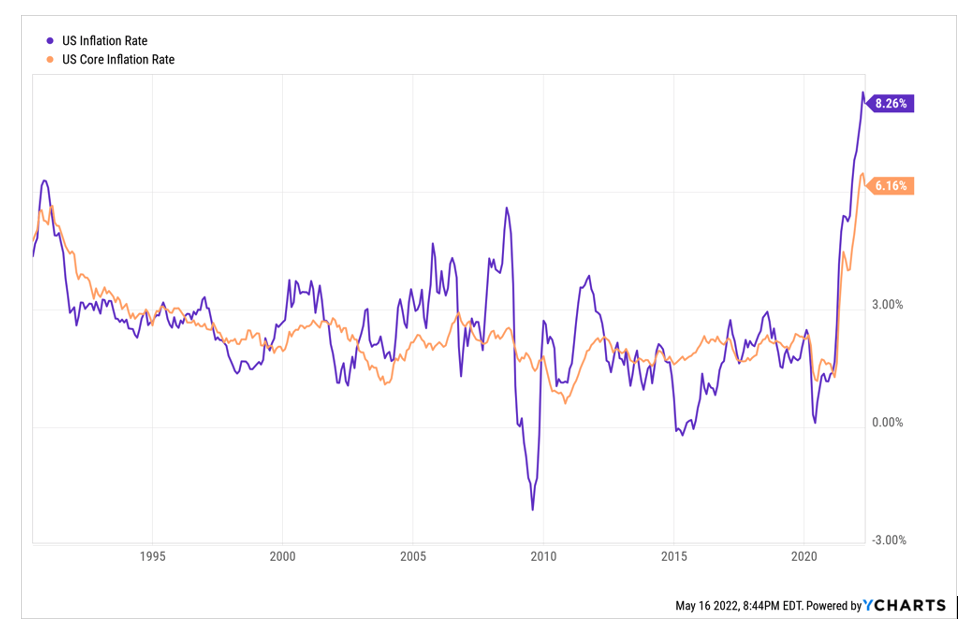

Shown in the chart below, the US inflation rate and core inflation rate is hitting levels not seen in the last 30 years.

This high inflation is having a harsh domino effect on financial markets. As rapid inflation prompts central banks to hike interest rates in efforts to control prices. Bond yields rise while prices fall, future corporate earnings are discounted, and equities sell-off.

This has led many to begin to search for alternative asset classes that may provide some protection against record-setting inflation.

Real Estate Remains Tried & True

Real estate is perhaps the first investment choice many think of when considering how to properly hedge against inflation. And for good reason. Real estate, as a real tangible asset, has little correlation with other asset classes like stocks or cryptos.

However, the truth behind real estate proving to be a safe haven against inflation is more complicated than many believe. And to properly use real estate as an effective hedge against inflation there are three critical factors investors should be aware of.

Because markets don’t move in unison, it makes sense to allocate your investments over a wide variety of assets so that you limit your exposure to any one asset type. You can look beyond listed stocks to bonds, real estate, precious metals, commodities, private placements, and other alternative investments. You maximize diversification by including a variety of alternative investments.

Reason #1: Time Invested Matters

Real estate can be a great hedge against inflation when held for an appropriate amount of time. The chart below shows two important metrics, the US inflation rate and the average sales price of US homes starting in 1995. Even now, in times of high inflation, the value of real estate has outpaced inflation in the long run. However, if we were to choose specific time periods within the graph the results would be less compelling. As high inflation, in short time periods, can dampen demand for real estate, meaning property values can experience slight downward pressure as consumers typically look to spend less (especially on large purchases such as buying a house).

This short-term downward trend, however, is off-set by real estate being a necessity for consumers. Or in other words, in the long run, consumers will continue to spend money on rent and housing costs regardless of the macroenvironment… People need places to live. They will look to cut spending in other areas such as the food they eat or the car they drive.

Reason #2: Buying the Right Kind of Real Estate

Real estate is an extremely broad asset class with many different subsections. And different types of real estate classes have their own strengths and weaknesses.

Office real estate is often characterized by long contracts with set rates. And in times of high inflation this can be seen as both a positive and a negative. More specifically, extended contracts offer more stability, however, this can also be problematic. As inflation can make maintenance expenses higher, if the rate is not renegotiated inflation will negatively affect an investor’s cash flow from the property.

On the other hand, retail real estate, or that which focuses on individual consumers, has contracts negotiated more often, meaning rates can be adjusted based-off current inflation, allowing property owners to keep pace with higher inflation.

One type of real estate isn’t necessarily better than the other. The important thing to remember is the differences between the two and to choose investments that fit your risk profile and overall portfolio strategy.

Reason #3: Real Estate Can Be an Income Producing Asset

Lastly, real estate is an incoming producing asset. Many stocks or cryptocurrencies provide little to no income for investors. Real estate, however, can at times provide consistent cash flow. And this, combined with asset appreciation is a large part of what makes it such an effective hedge against inflation.

Inflation often seeps across an entire economy. Meaning things like lumber and construction material will rise in cost. And as well, the wages of consumers will rise as the cost of living continues to increase. Real estate investments have the ability to adjust rents to keep in line with wages of workers in the area, as well as the costs associated with building maintenance. This in principle, is a powerful tool to hedge against inflation as the income produced from the asset can be adjusted based off inflation concerns.

In sum, investors can select from different alternative investments to increase their wealth while helping to protect against downside risk.

It’s Not a Perfect System

In actuality, real estate is not completely immune to the effects of increasing inflation. When inflation rises governments tend to tighten the country’s money supply, which means higher interest rates for borrowing, as well as higher mortgage rates. And as mortgage rates rise the selection of individuals who can afford to borrow money decreases. This can put a damper on the demand for housing, leading to suppressed valuations of certain real estate classes.

Additionally, rising inflation causes many to spend less in general. When ordinary things become more expensive like transportation, food, and various household items consumers tend to become more risk-averse in terms of making large purchases.

These factors (to a limited degree) can negatively affect the real estate market.

Final Thoughts

Real estate for decades has proven to be a very effective hedge against high inflation. As the real estate market is more affected by supply and demand, demographic trends, and construction, than inflationary pressures.

As well, real estate for many is considered a necessity, meaning individuals will still spend money on housing even with rising costs elsewhere.

And from an investment standpoint, real estate is able to hold its value regardless of rising interest rates, equities selling off, and inflation numbers posting 30-year highs. It has the ability to price in inflation in ways other asset classes can’t. And ultimately provides investors an extremely effective hedge against high inflationary periods when held for the long term.